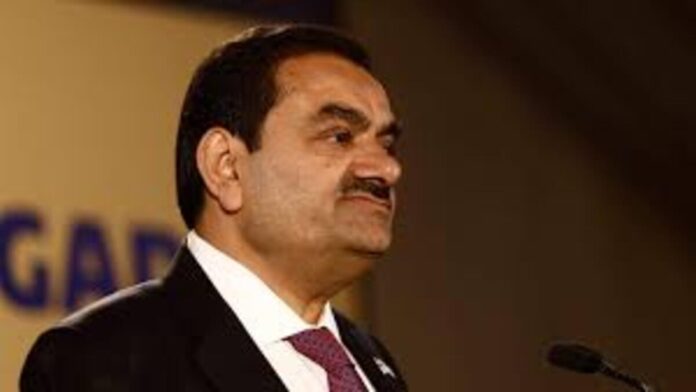

The Supreme Court hinted on Friday that it would extend the investigation into claims of stock price manipulation by the Adani Group and failures in regulatory compliance by three months. A six-month extension into the same was requested by SEBI.

The matter will now be considered on Monday, May 15 in order to address SEBI’s request for a delay.

A bench comprising Chief Justice DY Chandrachud, Justices PS Narasimha, and JB Pardiwala announced that the court registry had received the report of the Justice (retd) AM Sapre committee, which had been established by the Supreme Court, and that the panel would like to hear the case on Monday after reviewing its findings.

“We will go through the report in the meantime. We will take up the matter on May 15,” the bench said.

The court advised SEBI’s attorney general, Tushar Mehta, during the hearing that it might only give the market regulator three months rather than the six it had requested to complete its investigation into claims of stock manipulation.

The court warned a lawyer representing petitioner Jaya Thakur that it had not made any comments regarding any regulatory shortcomings on the part of SEBI.

“Be cautious while making accusations. The stock market’s sentiment may be impacted by this. The panel has been established to investigate all of your claims, the bench stated.

After a damning report by US short-seller Hindenburg destroyed more than $140 billion of the Indian conglomerate’s market value, the apex court ordered the Securities and Exchange Board of India (SEBI) to look into these allegations within two months and set up a panel to consider offering protection to Indian investors.

Earlier, SEBI claimed in a court appeal that it needs another six months to investigate potential violations involving “misrepresentation of financials, circumvention of regulations, and/or fraudulent nature of transactions.”

“Pass an order extending the time to conclude the investigation as directed by this Court by the common order dated March 2 by a period of 6 months or such other period as this court may deem fit and necessary in the facts and circumstances of the present case,” the SEBI plea said.

In light of the decline in the value of the stocks of the Adani Group, the top court stated on February 10 that Indian investors’ interests need to be safeguarded against market volatility. It subsequently requested that the Centre consider forming a panel of subject matter experts under the direction of a former judge to examine ways to strengthen the regulatory system. The proposal from the Supreme Court was accepted by the Centre.

These investigations are the most significant way India can convey to investors that it is willing to scrutinise its largest companies and bring them closer to international standards of corporate governance. Prime Minister Narendra Modi of India has remained largely silent on the controversy despite criticism from opposition parties.

The Hindenburg report, released on January 24, described a complex network of tax havens in the Caribbean, Mauritius, and the United Arab Emirates that the Adani family allegedly controlled and exploited to support corruption, money laundering, stock price manipulation, and tax evasion.

Despite the Adani Group’s repeated denials of these allegations, the market selldown that followed has reduced the market value of its listed firms by $100 billion.

One point made by Hindenburg that has drawn attention is how individuals, such as Vinod Adani, the unnoticed older brother of Gautam Adani, serve as directors of numerous foreign corporations that either invest in or conduct business with Adani’s company. This was described as “a vast labyrinth of offshore shell entities” by the US short seller who moved billions of dollars into Adani firms without disclosing “of the related party nature of the deals.”